One Homebuying Step You Don’t Want To Skip: Pre-Approval

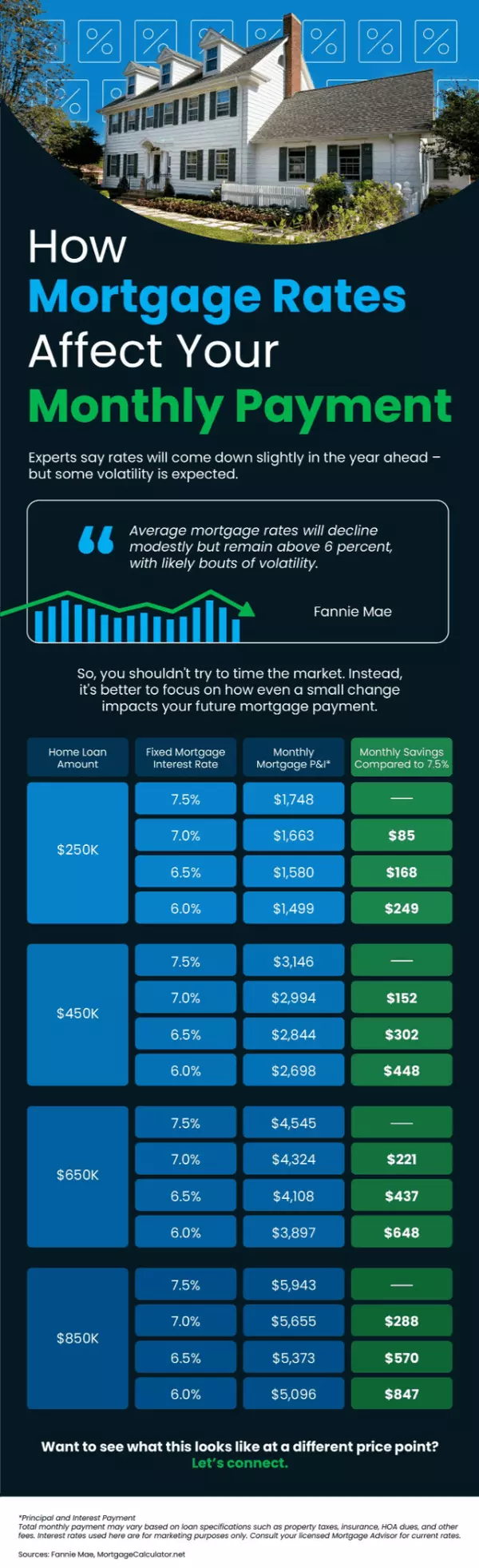

One Homebuying Step You Don’t Want To Skip: Pre-Approval There’s one essential step in the homebuying process you may not know a whole lot about and that’s pre-approval. Here’s a rundown of what it is and why it’s so important right now. What Is Pre-Approval? Pre-approval is like getting a green light from a lender. It lets you know how much they’re willing to let you borrow for a home. To determine that number, a lender looks at your financial history. According to Realtor.com, these are some of the documents a lender may ask you for during this process: W-2s from the last two years Tax returns from the last two years Pay stubs from the last 30 days Bank statements from the last 60 days Investment account statements (if applicable) Two years of history of where you’ve lived The result? You’ll get a pre-approval letter showing what you can borrow. Keep in mind, that any changes in your finances can affect your pre-approval status. So, after you receive your letter, avoid switching jobs, applying for new credit cards or other loans, or taking out large sums of money from your savings. How It Helps You Determine Your Borrowing Power This year, home prices are expected to rise in most places and mortgage rates are still showing some volatility. So, since affordability is still tight, it’s a good idea to talk to a lender about your home loan options and how today’s changing mortgage rates will impact your future monthly payment. The pre-approval process is the perfect time for that. Because it determines the maximum amount you can borrow, pre-approval also helps you figure out your budget. You should use this information to tailor your home search to what you’re actually comfortable with as far as a monthly mortgage payment. That way, you don’t fall in love with a house that’s out of your comfort zone. How It Helps You Stand Out Once you find a home you want to put an offer on, pre-approval has another big perk. It not only makes your offer stronger, it shows sellers you’ve already undergone a credit and financial check. When a seller sees you as a serious buyer, they may be more attracted to your offer because it seems more likely to go through. As Greg McBride, Chief Financial Analyst at Bankrate, says: “Preapproval carries more weight because it means lenders have actually done more than a cursory review of your credit and your finances, but have instead reviewed your pay stubs, tax returns and bank statements. A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.” Bottom Line If you’re planning on buying a home, getting pre-approved for a mortgage should be one of the first things on your to-do list. Not only will it give you a better understanding of your borrowing power, it can put you in the best position possible to make a strong offer when you find a home you love. Connect with a trusted lender to learn more.

Roughly 11,000 Homes Will Sell Today – Will Yours Be One of Them?

Roughly 11,000 Homes Will Sell Today – Will Yours Be One of Them? Are you hesitant to sell your house because you’re worried no one’s buying with rates and prices where they are right now? Here’s some perspective that can help. The market actually isn’t at a standstill. While there weren’t as many sales last year as there’d be in a normal market, roughly 4.15 million homes still sold (not including new construction), according to the National Association of Realtors (NAR). And the expectation is that number will rise in 2025. That means more people will likely move this year, and they need homes to buy. Homes like yours. But even if we only match last year’s sales pace, here’s what that looks like. Every Minute Homes Are Selling – Literally 4.15 million homes ÷ 365 days in a year = 11,370 homes sell each day 11,370 homes ÷ 24 hours in a day = 474 homes sell per hour 474 homes ÷ 60 minutes = roughly 8 homes sell every minute Think about that. Just in the time it took you to read this, 8 homes sold. If you’ve been holding off on selling your house because you think buyers aren’t out there, let this reassure you – there are still buyers looking to buy. Every day, thousands of people need to buy homes. So, while higher home prices and mortgage rates have slowed the market down and forced some buyers onto the sidelines, that doesn’t mean the market isn’t active. Many buyers are still eager to make a move because life doesn’t wait for perfect market conditions. With the right agent by your side, you can get your house in front of those buyers while other hesitant homeowners are still putting their plans on pause because they’re worried buyer demand has disappeared. Let’s get your house sold. Bottom Line On average, over 11,000 homes sell every day, and yours could be one of them. In the time it took you to read this, another 8 homes sold. When you’re ready to take the next step, let’s connect so you have an agent to create that perfect strategy.

The Truth About Credit Scores and Buying a Home

The Truth About Credit Scores and Buying a Home Your credit score plays a big role in the homebuying process. It’s one of the key factors lenders look at to determine which loan options you qualify for and what your terms might be. But there’s a myth about credit scores that may be holding some buyers back. The Myth: You Need To Have Perfect Credit According to Fannie Mae, only 32% of potential homebuyers have a good idea of what credit score lenders actually require. That means two-thirds of buyers don’t actually know what lenders are looking for – and most overestimate the minimum credit score needed. The Reality: Perfect Isn’t Necessary But the truth is, you don’t need perfect credit to become a homeowner. To see the average score, by loan type, for recent homebuyers check out the graph below: There is no set cut-off score across the board. As FICO explains: “While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders, and there are many additional factors that lenders may use . . .” So, even if your credit score isn’t as high as you’d like, you may still be able to get a home loan. Just know that, even though you don’t need perfect credit to buy a home, your score can have an impact on your loan options and the terms you’re able to get. Work with a trusted lender who can walk you through what you’d qualify for. Simple Tips To Improve Your Credit Score If you want to open up your options a bit more after talking to a lender, here are a few tips from Experian and Freddie Mac that can help give your score a boost: 1. Pay Your Bills on Time This includes everything from credit cards to utilities and other monthly payments. A track record of on-time payments shows lenders you’re responsible and reliable. 2. Pay Down Outstanding Debt Reducing your overall debt not only improves your credit utilization ratio (how much credit you’re using compared to your total limit) but also makes you a lower-risk borrower in the eyes of lenders. That makes them more likely to approve a loan with better terms. 3. Hold Off on Applying for New Credit While opening new credit accounts might seem like a quick way to boost your score, too many applications in a short period can have the opposite effect. Focus on improving your existing accounts instead. Bottom Line Your credit score doesn’t have to be perfect to qualify for a home loan. The best way to know where you stand? Work with a trusted lender to explore your options.

Recent Posts